As the opportunity for the Nasdaq index to refresh its annual high last week fell just short, market sentiment began to reverse, and many previously overlooked negative signals began to occupy investors’ minds, gradually amplifying market volatility.

After Monday’s opening, Meta, one of the “Big Seven” leading US stocks that have driven the rise this year in the metaverse concept stock, opened with a gap down and fell nearly 3% as of press time. On the news front, media reports on founder Mark Zuckerberg’s frequent selling of stocks over the past month have raised concerns in the investment market.

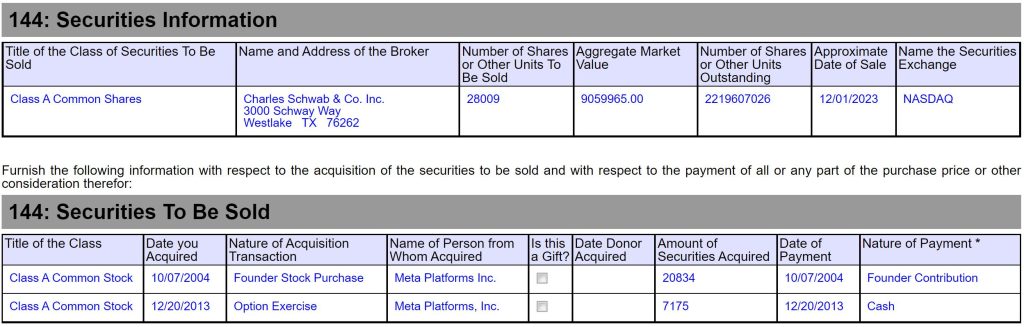

According to Form 144 found on SEC’s official website, Zuckerberg’s most recent stock sale should have been last Friday when he sold 28,009 shares of Meta stock for nearly $9.05 million.

However, there is also a column called “Past Three Months” in Form 144 which shows that since November 1st (excluding weekends and Thanksgiving Day holiday on November 23rd), Zuckerberg has been selling 28,009 shares every trading day without interruption. The total cumulative sales amount exceeds 600 thousand shares with cash proceeds exceeding $180 million.

Of significant signaling significance is that this is also the first time since November 2021 that physical entities managing Zuckerberg family wealth have sold Meta stocks.

Investors familiar with Meta and VR industry may still remember that this company reached its historical peak in Q3 of 2021. Since then, Zuckerberg’s bet on the “metaverse” vision has become a “poison” for stock prices plunging from over $380 at its peak to just a fraction left. Amid investor complaints, Zuckerberg also halted his pace of selling stocks until November this year. The surge of more than 180% within this year made his actions appear extremely accurate.

It is reported that besides Meta,Zuckerberg is also pursuing multiple businesses, including VC venture capital, medical research, and political ambitions.

For example, the “Chan Zuckerberg Initiative” founded by Zuckerberg couple promised earlier this year to invest $250 million in Chicago to establish a biomedical research center. Like Buffett, the Zuckerberg couple also pledged to donate 99% of their wealth for charitable purposes during their lifetime. Considering that Zuckerberg is only 39 years old this year, he still has plenty of time to fulfill his charitable commitments.

According to estimates, Zuckerberg currently holds nearly 13% of Meta shares with a total net worth close to $120 billion,making him the ninth richest person globally. According to recent regulatory filings, the Chan Zuckerberg Initiative has net assets close to $6.3 billion. In addition to funding medical research, past projects of this foundation include helping solve housing shortages in the San Francisco Bay Area and training software engineers for the African continent.

Returning back to stock sales,in addition to Meta which had the second highest increase among US tech giants this year,news emerged about “insiders planning on selling 370 thousand shares in November” from Nvidia which had the highest increase. Interestingly enough,Apple’s Chief Accounting Officer Chris Kondo disclosed Form 144 last week showing sales of nearly $1 million worth Apple stocks。The stock prices of Apple and Nvidia also weakened on Monday further dragging down overall market performance.